35+ Years Originating Residential Loans

We’ve helped thousands of borrowers

Abo Capital offers mortgage loans for residential properties. Our home loans are primarily used to leverage residential investment opportunities.

Investors are attracted to our prime-rate jumbo mortgage loans, interest-only loans and our full doc loans that do not require mortgage insurance. For eligible properties, we can finance up to 95% of the appraised value.

We accept residential loan applications from US citizens and from foreign borrowers.

No Income Qualification

Proof of income is not required for borrowers or for the subject property.

Qualified investors typically experience a faster funding process with no-ratio property loans.

No-ratio residential mortgage loans may be issued to eligible entities that are legally established LLCs or corporations within a US state or the District of Columbia.

Residential Loan Features

- Jumbo prime bank statement program up to $10,000,000

- Interest only option is available

- Loan amount and LTV is based on recent credit experiences

- Fixed-rate residential home loans

- Adjustable-rate mortgage loans

- Fully amortized loans for 5/1 ARMs, 7/1 ARMs, 15-year fixed, and 30-year fixed

- No prepayment penalty options for residential investor loans

- 50% maximum debt-to-income ratio

- Purchase / rate and term refinance

- Cash-out refinance

- 90% LTV up to $10,000,000 (700 min. credit score, 1 year of tax return or W2s)

- 85% LTV up to $2,000,000 (680 minimum credit score)

- 80% LTV up to $2,000,000 (640 minimum credit score)

- 80% LTV up to $1,500,000 (Investment or business)

- Qualify with bank statements, tax returns, no ratio or no income verification

- No prepayment penalty option for residential investor loans

- No minimum credit score (purchase to 75% LTV, Refinance to 70% LTV)

- 90 days of title seasoning for rate and term or cash-out refinances

- Loans for Foreign Nationals on 2nd home or investment properties

- Gifts are permitted on purchases

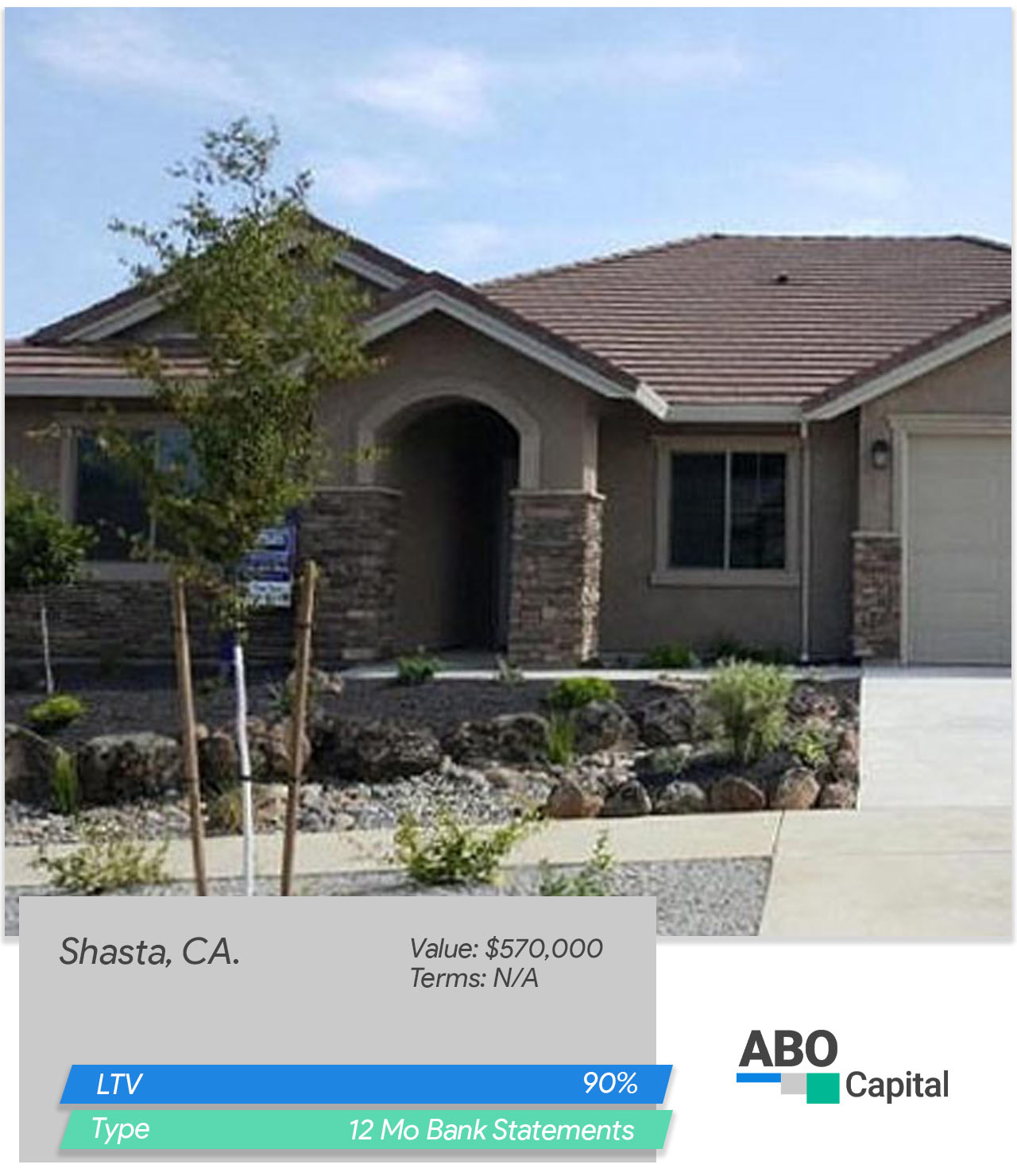

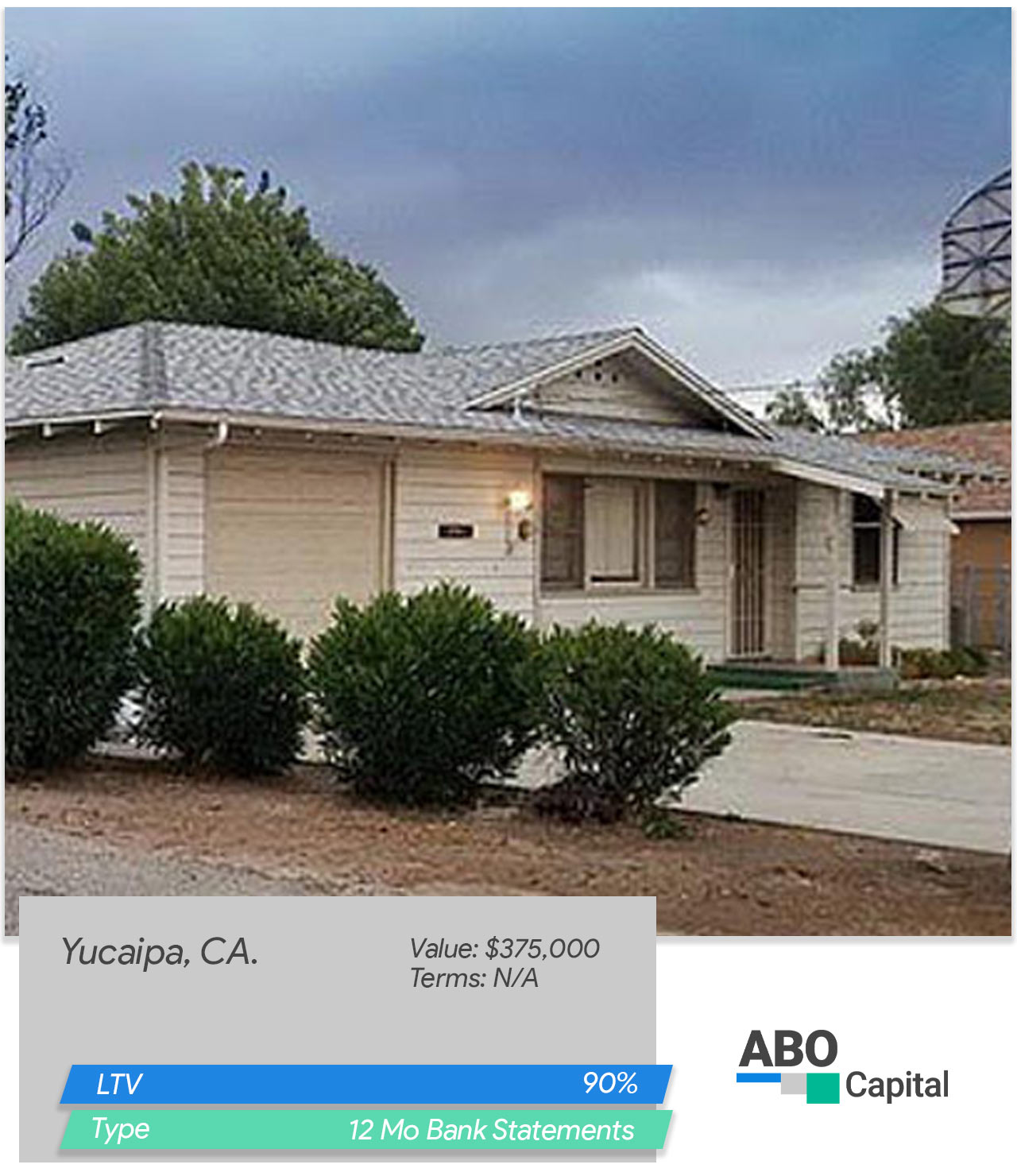

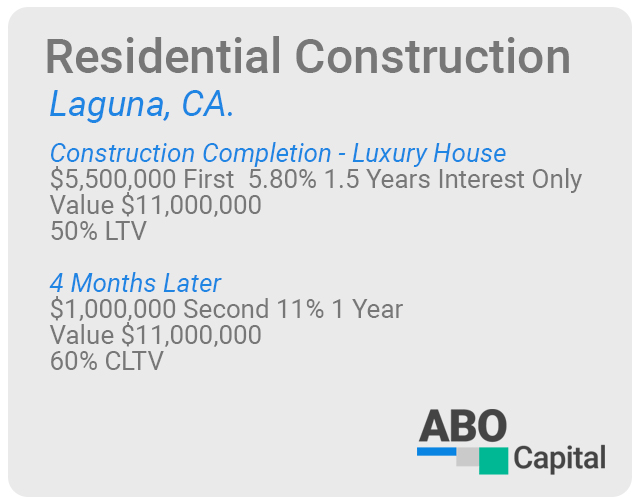

Past Deals